|

Banking is one of the most sought after career choices

The Indian economy has been progressing on the path of economic reforms for more than a decade. India is currently the second fastest growing economy in the world.

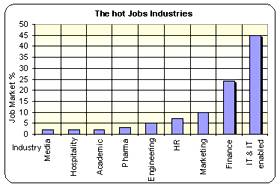

The latest survey of Assocham has shown that financial sector has created 24% of the total jobs in Indian cities. IT sector is number one job generator with 45% of total jobs in the cities. Financial sector accounts for more than 50% jobs in Indian cities, when jobs created by IT sector in financial segment are added to the same. (http://www.indiainfoline.com/mufu/fina.html)

Credit growth has helped banks post good core operating results. There is a fast growing demand for Mutual Funds, Insurance, Equities and Commodities. This positive environment for investment amongst Indians definitely signals a better future for financial services sector.

Banking today is technology driven both due to a combination of regulatory and competitive compulsions. Banks seek solutions that will get them started immediately. Such an environment therefore calls for experts from IT domain as well.

Banking a sought after career

Banking is one of the most sought after career choice among the students. The emergence of new technology-driven banks has broadened the scope and range of banking services. Furthermore, entry of Financial Institutions into the short-term lending business is resulting in need for more professionals.

The Private sector with the entry of new banks mostly promoted by the major Financial Institutions like IDBI, ICICI, has provided competition to both Public sector and Foreign Banks. They are more technology savvy and offer better salaries than Public sector Banks. Unlike public sector banks, the promotional avenues are not time-bound.

Foreign Banks are the most sought after due to their salary packages comparable to the best in the country and better job profiles. However, in addition to personal performance, the job security in these banks is also dependent on various external factors, like the economy of the parent country, performance of the bank worldwide, change in expatriate management etc.

Opportunities:

A banking career offers a wide range of opportunities in:

Personal Financial Services;

- Commercial Banking;

- Corporate Banking,

- Investment Banking;

- Private Banking;

- Branch Banking;

- Wholesale Banking;

- Retail Assets;

- Treasury;

- Equities;

- Depositories;

- Trade Services;

- Cash Management;

- Insurance;

- Consumer and Business Finance;

- Pension and Investment Fund Management;

- Trustee Services;

- Securities and Custody services.

Qualification:

For an entry level, Sales, Marketing and Operations job with the banks; one can be a plain graduate. As per an ICICI bank research, the competencies which indicate success at the entry level in a Bank are:

- Drive for results

- Process Orientation

- Interpersonal Effectiveness

- Analytical Thinking

- Innovation &

- Team Effectiveness

To join foreign or private sector banks at higher than entry level one needs specialisation in some specific areas. For example expertise in project analysis, credit appraisal skills, managing huge loan portfolios, general and foreign exchange and money. Good computer knowledge is always preferred.

Banks also recruit engineering graduates, MCAs and commerce graduates with an aptitude for software development, trained graduates from well known software training institutes, as database administrators. They look after the efficiency, access security, retrieval, archiving and development of computerised database. Their job also involves, managing database space, optimising performance, performing periodical backups, developing reports and cross references from the data dictionary and implementing disaster recovery operations.

Global Industry :

Unlike any other industry, banking is truly global in its nature. Most of the banks today have significant operations across the world. It is one such sector which offers a dynamic working environment and where trading continues round the clock across a multitude of economies, cultures and currencies.

Whatever area of a bank you decide to join, it is highly likely that you will work as part of a multi-skilled team. This engenders a culture of sharing ideas and knowledge across international markets and other business units.

You will undoubtedly have a steep learning curve, which will not flatten, if you wish to progress. From an early stage you will be prepared for new challenges, promotion, inter-departmental and branch transfers as well.

For Comments: psjamwal@amity.edu |